IRS Publication 502 Medical Expense: What can be deducted tax-free

IRS Publication 502 Medical Expense: What can be deducted tax-free

IRS Publication 502 Deductions - Main Content Table of Contents What Are Medical Expenses? What Expenses Can You Include This Year?.

Where you only pay once, not every year for a Section 125 premium only plan, health FSA, dependent care FSA, Wrap SPD, QSE-HRA or HRA plan document. The trusted source for over 20 years and 40,000 satisfied customers.

Qualified Medical Expenses an HRA Covers

Guidelines for People with Disabilities for Deducting Medical Expenses

Are Medical Alert Devices Tax Deductible?

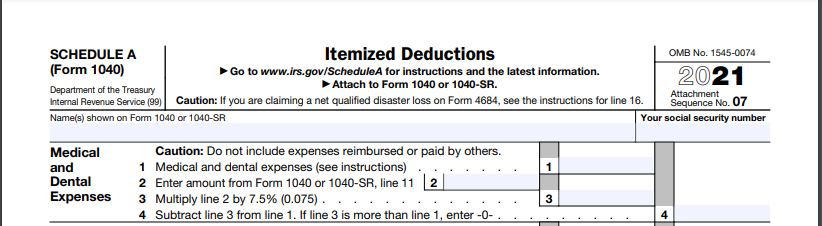

Medical Expense Deduction: How To Claim A Tax Deduction For Medical Expenses

Can In-Home Care Expenses be Written Off on Taxes?

The IRS and Incontinence Supplies — Home Care Delivered

Did You Pay Medical Expenses In 2021? New Rule For Medical Deductions! - West Ridge Accounting Services

Medical Expenses and Taxes: What You Need to Know - WSJ

Are medical expenses tax deductible?

:max_bytes(150000):strip_icc()/20-ways-use-your-flexible-spending-account_final_rev-d861e123d8b64ced89a51a3b178f7fc4.png)